Understanding the Basics of Business Taxes in the USA

Before diving into the specifics of various business taxes, it's essential to understand the basics. In the USA, business taxes are levied at both federal and state levels, and sometimes even at local levels. These taxes are imposed on business income, property, sales, and sometimes even on the payroll. The type and amount of taxes a business owner must pay depend on the structure of the business - whether it's a sole proprietorship, partnership, corporation, or LLC. It's crucial to understand these basics as it sets the foundation for the rest of our discussion.

Overview of Federal Business Taxes

At the federal level, the Internal Revenue Service (IRS) is responsible for tax collection. The type of federal tax a business owes depends on its structure. For instance, sole proprietorships, partnerships, and LLCs usually pay income tax through the owner's personal tax returns. On the other hand, corporations pay corporate income tax on profits, separate from the owner's personal taxes. Let's take a closer look at these federal taxes.

Income Tax for Sole Proprietorships, Partnerships, and LLCs

If you own a sole proprietorship, partnership, or LLC, your business income is likely to be taxed as personal income. This is known as "pass-through" taxation because the business income "passes through" to the owner's individual tax return. The rate at which you'll be taxed depends on your tax bracket. It's crucial to understand this as it directly impacts your personal finances.

Corporate Income Tax

If your business is a corporation, it's treated as a separate tax entity. Corporations are subject to a flat federal corporate income tax rate on their profits. As of 2021, the federal corporate tax rate is 21%. However, corporations can also face double taxation when the corporation's earnings are distributed to shareholders as dividends. These dividends are then taxed again on the shareholder's personal tax return.

Self-Employment Tax

Self-employment tax is a Social Security and Medicare tax primarily for individuals who work for themselves. If you're a sole proprietor, partner, or LLC member, you're considered self-employed and must pay this tax. The current self-employment tax rate is 15.3%, with 12.4% going towards Social Security and 2.9% towards Medicare. Understanding this tax is crucial, especially if you're a freelancer or independent contractor.

Employment Taxes

If you have employees, you're required to pay employment taxes. These include Social Security and Medicare taxes, federal income tax withholdings, and Federal Unemployment Tax Act (FUTA) taxes. Employers have a responsibility to withhold these taxes from their employees' wages and pay them to the IRS. Failure to do so can result in severe penalties.

Excise Taxes

Excise taxes are paid when purchases are made on specific goods, such as gasoline. Businesses may also be required to pay excise taxes if they manufacture or sell certain products, operate certain kinds of businesses, use various kinds of equipment, facilities, or products, or receive payment for certain services. It's essential for business owners to understand whether these taxes apply to their business operations.

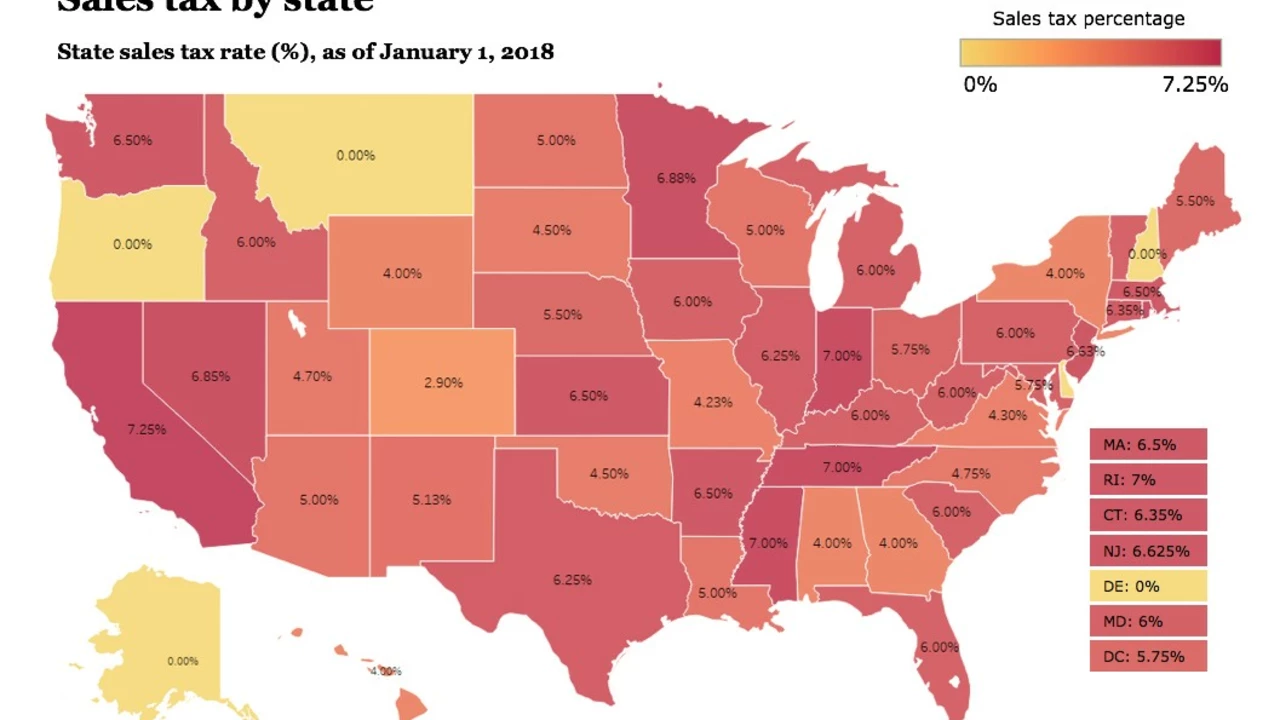

Understanding State Business Taxes

In addition to federal taxes, businesses are also subject to state taxes. These can include income taxes, sales taxes, property taxes, and more. The type and amount of state taxes a business owes depend on the state in which the business operates. Each state has its own tax laws, making it crucial for business owners to understand the tax obligations in their specific state.

Local Business Taxes

Depending on the locality, businesses may have to pay additional local taxes. These can include property taxes, gross receipts taxes, and occupational taxes. Local taxes vary widely from one locality to another, so business owners must understand their local tax obligations.

Navigating Business Tax Deductions and Credits

Lastly, it's essential to understand the tax deductions and credits available to your business. These can significantly reduce your tax liability. Deductions reduce your taxable income, while credits reduce your taxes owed. Common deductions include business expenses like rent, utilities, and supplies, while credits can be available for activities like research and development or hiring certain types of employees.

Write a comment